The UK’s Corporate Insolvency and Governance Act (CIGA) became law on 26th June 2020 ushering in what one magic circle law firm described as “the most significant insolvency reforms for a generation”. The legal profession has written many excellent articles explaining the content of this 250 page Act. We want to look at what businesses need to understand about how this legislation will impact both those in financial difficulty and also those who find themselves customers or suppliers of such businesses. First, let’s understand how we got here.

The EU set out a proposal in 2014. The opening paragraph stated:

“The European Commission has today set out a series of common principles for national insolvency procedures for businesses in financial difficulties. The objective is to shift the focus away from liquidation towards encouraging viable businesses to restructure at an early stage so as to prevent insolvency. With around 200,000 businesses across the EU facing insolvency and 1.7 million people losing their jobs each year as a result, the Commission wants to give viable enterprises the opportunity to restructure and stay in business. Reforming national insolvency rules would create a “win-win” scenario: it will help keep viable firms in business and safeguard jobs and at the same time improve the environment for creditors who will be able to recover a higher proportion of their investment than if the debtor had gone bust.”

The UK government was quickly out of the blocks with a consultation in 2015 and a further one in 2018 on proposals for incorporating this into UK law. After that, everything went quiet as Brexit meant insufficient parliamentary time to bring the legislation forward. Then came COVID- 19, and the government announced in late March that it would bring this legislation forward as a response to try and stop a tidal wave of insolvencies and help viable businesses survive.

The legislation has been moved onto the statute book with incredible speed. The Bill was published in six weeks when it would ordinarily have taken many months and it passed through Parliament and into law in six weeks. This is breakneck speed for new legislation.

NEW LAWS TO PROMOTE COMPANY RESCUES WHAT DO THEY MEAN FOR BUSINESSES?

As mentioned, most of the larger law firms have published summaries of the Act and this link to a summary by Freshfields should help in understanding the legalities of the Act:

http://ssl.freshfields.com/noindex/documents/0620/Corporate-Insolvency-and-Governance- Act-client-note.pdf

The Act contains various temporary measures related to COVID-19. These are mainly on filing accounts, holding AGM’s and the suspension of winding-up orders and wrongful trading. Whilst helpful, they are temporary so we will not discuss them here. Looking at the three permanent measures, we have some thoughts on the practical considerations.

The Moratorium

A “breathing space” where creditors cannot take any action against the company is a welcome addition to the toolkit. Previously the only way to get a moratorium was through a Notice of intent to appoint an Administrator or by entering Administration or the little used CVA Moratorium. The new Moratorium gives a free-standing procedure outside of insolvency and with management remaining in charge, supervised by a licensed Insolvency Practitioner (IP). There is a payment holiday from Pre-Moratorium debts subject to certain exclusions, in particular financial debts. In practice, lender support will be necessary before a Moratorium can be commenced. Additionally, super-priority funding during the Moratorium could be arranged with the approval of the Monitor. It will be interesting to see if that becomes common place.

The initial Moratorium period of 20 days, extendable to 40, is shorter than in the previous consultations. Our first reaction was disappointment. However, when looked at in the context of the Act as a whole it is clear the government intended it should normally be a short process with most of the work completed up front.

An unexpected provision of the legislation is the exclusion of most companies with traded instruments greater than £10m in their capital structure. Most public companies on the main markets and AIM whose shares are traded and those with traded debt instruments, e.g. bonds are unable to use the new Moratorium procedure. This signals that the government wants to focus this procedure on smaller businesses which will not have such complex capital structures.

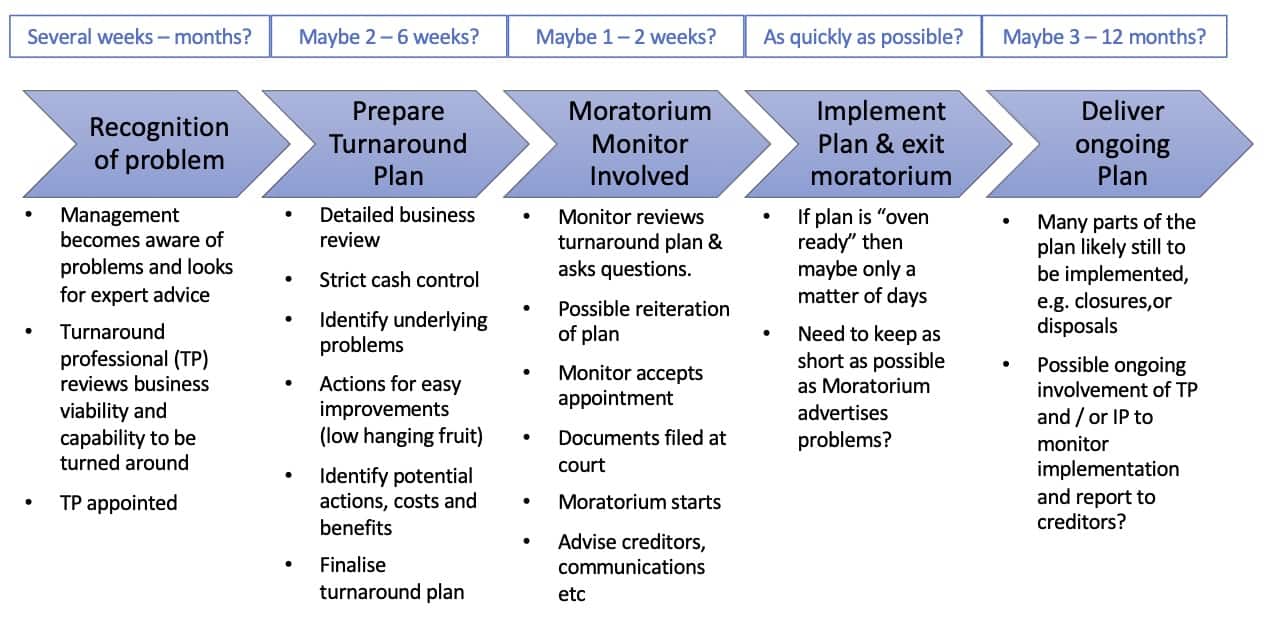

The conditions for entering a Moratorium are twofold. The company must be approaching insolvency and it must be likely that it can be rescued as a going concern. The proposed Monitor has to certify that he agrees with both those assertions. That cannot happen instantaneously. There will need to be evidence by way of financial information, forecasts and the assumptions underpinning them. More importantly, there will have to be a plan that demonstrates the company can likely be rescued as a going concern. No IP is going to risk certifying something that has no substance. That is going to require a lot of preparation. Timing will always vary by individual business, but this example illustrates how a complete turnaround might look

At present, many company directors go through a lengthy period of denial that they have a problem. Fear of the stigma of insolvency and the loss of control is a factor. The upshot is that by the time they seek help it is often too late or at the very least, much harder to rescue the business. We believe the new laws have been drafted to try and change that mindset and to give a strong incentive for companies to seek help earlier. We would certainly encourage that.

The Moratorium should be seen as just a part of a much longer process to rescue a company. Indeed, it needs to be approached with care. As soon as a company enters a Moratorium it has to advise all its creditors and Companies House of the fact and state that it is in a Moratorium on all letters, orders etc. It will be very public knowledge and that will provoke concern and difficulties with customers, suppliers, employees and other stakeholders. A communication plan for day 1 and on an ongoing basis will be essential. We believe that companies will only want to be in a Moratorium for the shortest time possible.

It may be possible that with a credible rescue plan, creditors and others can be persuaded not to take any actions, thus making a Moratorium unnecessary. Its real benefit is if dissenting creditors take enforcement action against the company. That is the current risk in a consensual turnaround, and we wonder whether the fact the Moratorium procedure exists and can be used to prevent creditor disruption, may be a threat which brings dissenters into line. Could it be a great tool, the threat of which means it rarely gets used?

The Restructuring Plan (RP)

This is a tool for restructuring debt. It is in many ways similar to the existing Scheme of Arrangement (SoA), part of company law as opposed to insolvency law. The big difference is the ability to “cram down” across classes of creditors rather than just within a class. This should make it a more flexible tool. Cramming down means the ability to force minority dissenting creditors to be bound by the approval of a 75% majority of creditors with a financial interest to vote for the RP.

The new RP legislation also has simpler rules for who can vote. By excluding those who have no economic interest in the outcome it should prevent creditors taking hold-out or ransom positions. This should make the procedure simpler, quicker and less expensive. The big issue that could arise is valuation. Valuing a business has never been a precise science and is harder when the business is financially distressed. There could be some interesting battles over valuation where it has a bearing on who has an economic interest and who doesn’t.

SoA’s have traditionally been expensive. The first one we worked on incurred legal fees alone of over £4m. There have been examples of smaller and much cheaper ones. We think we could see simpler, quicker RP’s and a drive to keep the cost down so that smaller businesses may be able to benefit. It will probably never be available to the smallest of businesses but could be a very useful new tool for medium sized businesses.

Another interesting aspect of the RP is that for court approval, the plan has to give a better return than the next best alternative. We believe this is likely to mean a comparison to an insolvency process such as Administration, or maybe a CVA. It is hard to see how Liquidation could be the next best alternative if the underlying business is viable if the plan is approved. As a result, the RP will have to be supported by a credible rescue plan rather than just the threat of Liquidation as the only alternative. Again, we think it is clear the government wants to encourage genuine business rescues rather than just rejigging the Balance Sheet. This is a welcome and much needed incentive for management to act early and look to holistically turn a business around rather than just tinker with its funding and balance sheet.

Other Permanent New Laws

The other main provision is for the protection of supplies through the banning of “Ipso-Facto” clauses in contracts. This means clauses that automatically terminate or otherwise change the terms of a contract on the triggering of an insolvency process, Moratorium or RP and should mean that creditors are unable to take ransom positions. It excludes financial creditors so will primarily impact trade creditors. This should be helpful to a distressed business, but it may cause counterparties to change contracts so they can be terminated in advance of any of the listed procedures. Even where such provisions are banned at present, they have always been hard to enforce. What do you do when the supplier says your goods are on their way and then later tells you the truck has broken down? It happens.

Implications for businesses not in distress

The banning of Ipso-Facto clauses has implications for suppliers and customers of businesses in distress. They will suddenly find themselves facing situations where they cannot terminate or change the conditions of a contract as a result of the other party entering a process.

Businesses could find themselves with customers suddenly announcing they have entered a Moratorium with all pre-Moratorium debts frozen. That could have serious implications for cash flow. Restructuring Plans could also have a major impact. As unsecured creditors, trade creditors are likely to bear much of the pain of RP’s if secured and other creditors are able to make the 75% threshold and force RP’s through. This is not dissimilar to what has happened in

many retail businesses where landlords have been out-voted and had lease cancellations and rent reductions forced upon them. However, unsecured creditors do need to understand that these new laws should offer a better return than they get in current insolvency processes, which is normally next to nothing.

These new laws will impact large numbers of businesses going forward so boards need to understand the potential implications and assess what the risks might be and how they can be mitigated. Reviewing terms and conditions of trade is an obvious first step but over and above that, understanding your place in supply chains, what the risks are and having contingency plans will be a wise move so that you aren’t caught unprepared.

Interaction of the New Procedures and other comments

The Moratorium and the RP are independent stand-alone procedures so one can be used without the other. But they can and undoubtedly will be used together in certain circumstances. A Moratorium is a very useful tool to prevent disruption by dissenting creditors before a RP is implemented to cram them down. There are also certain implications when a business that has been subject to a Moratorium enters an insolvency procedure within 12 weeks of exiting the moratorium. Expert advice will be required, both legal and financial, to navigate these waters.

Given how quickly the legislation was drafted, the government has included numerous provisions for future amendments without having to enact primary legislation. This clearly indicates the government’s intention to tweak the legislation if parts of it are seen to require it. The government has also decided not to be too prescriptive about certain issues. They are happy to let the courts sort out the exact interpretation and we do have a very experienced judiciary in this country.

Conclusion

The realisation that Insolvency laws needed altering to better enable the genuine rescue of viable businesses was already there but that need has been magnified many times over by the COVID-19 crisis. Many businesses that were viable and performing well, will find themselves in difficulty. Insolvency can’t be the only choice. Insolvencies cause insolvencies in suppliers and customers, setting off a domino effect. Some predictions are for an increase in UK business failures from less than 20,000 a year to well into six figures. Such a tsunami of value destruction would be disastrous for the economy, so it is no surprise the government has acted. However, there will be implications for customers and suppliers as these new procedures start to be used.

We believe the new legislation sends a clear message that directors need to throw off the shackles of stigma, fear and denial. Acting early and positively to ensure good viable businesses survive should become a badge of honour, not an act of shame. Recent presentations by the government’s Business Department Insolvency Service have had this banner:

As professionals, BM&T have helped many companies, large and small, through a turnaround and a recovery to health. We welcome this initiative and look forward to the new tools in our bag helping to rescue many more.